QuickBooks Online is a popular accounting software used by businesses of all sizes to manage their financial transactions. One of the features offered by QuickBooks Online is the ability to create delayed charges. In this article, we will explore what delayed charges are, how they work, and how businesses can benefit from using them.

Contents

Understanding Delayed Charges

Delayed charges in QuickBooks Online are transactions that you create to record sales or services provided to a customer, but you don’t receive payment for them immediately. Instead, you create an invoice or sales receipt for the customer, and the payment is expected at a later date.

Delayed charges are commonly used in situations where businesses provide goods or services to customers on credit. For example, if you own a consulting firm and provide services to a client, you can create a delayed charge to record the services rendered and the amount owed by the client.

How Delayed Charges Work

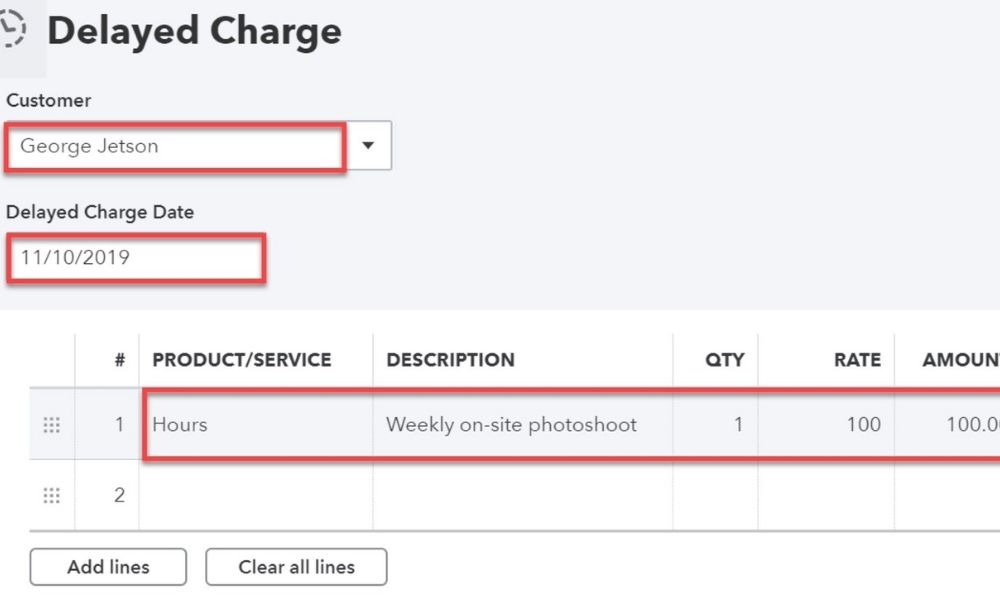

When you create a delayed charge in QuickBooks Online, you need to provide the following information:

- Customer: The name of the customer who will be billed for the delayed charge.

- Product/Service: The product or service that was provided to the customer.

- Quantity: The quantity of the product or service provided.

- Rate: The rate at which the product or service was sold.

- Date: The date on which the delayed charge was created.

Once you have entered all the necessary information, QuickBooks Online will create an invoice or sales receipt for the delayed charge. This document will include the details of the transaction, such as the customer’s name, the product or service provided, the quantity, rate, and the total amount owed.

Read:What is honda service pass?When the payment for the delayed charge is received, you can record it in QuickBooks Online by applying the payment to the invoice or sales receipt. This will update your accounts receivable and reflect the payment in your financial records.

Benefits of Using Delayed Charges

Delayed charges offer several benefits to businesses using QuickBooks Online:

- Accurate Financial Reporting: By using delayed charges, businesses can accurately track their sales and revenue, even if the payment is received at a later date. This allows for more accurate financial reporting and helps businesses make informed decisions based on up-to-date information.

- Improved Cash Flow Management: Delayed charges help businesses manage their cash flow by allowing them to record sales and services provided, even if the payment is not received immediately. This can be particularly useful for businesses that offer credit terms to their customers.

- Streamlined Invoicing Process: Creating delayed charges in QuickBooks Online simplifies the invoicing process. Businesses can easily generate invoices or sales receipts for delayed charges, saving time and effort compared to manual invoicing methods.

- Enhanced Customer Relationships: By using delayed charges, businesses can maintain a clear record of the products or services provided to each customer and the amount owed. This helps in building stronger customer relationships by ensuring accurate billing and timely follow-ups for payments.

Example Scenario

Let’s consider an example to illustrate how delayed charges work in QuickBooks Online:

Read:What does it mean if wifi is secure banzai?ABC Marketing is a digital marketing agency that provides advertising services to various clients. They create a delayed charge in QuickBooks Online for a client named XYZ Corporation. The delayed charge includes the details of the advertising services provided, such as the number of ad campaigns, the rate per campaign, and the total amount owed by XYZ Corporation.

After a month, XYZ Corporation makes the payment for the advertising services. ABC Marketing records the payment in QuickBooks Online by applying it to the delayed charge. This updates their accounts receivable and reflects the payment in their financial records.

Read:What is level 6 wind resistance for drones?Conclusion

Delayed charges in QuickBooks Online are a valuable tool for businesses to record sales and services provided to customers, even if the payment is not received immediately. By using delayed charges, businesses can accurately track their revenue, manage their cash flow, streamline their invoicing process, and enhance customer relationships.

Whether you offer credit terms to your customers or simply want to keep a record of outstanding payments, delayed charges in QuickBooks Online can help you maintain accurate financial records and make informed business decisions.